The Shift to a Five Axelspace GRUS Satellite System. The roadmap to achieving profits of $100 million.

Axelspace released their plans to launch four GRUS small satellites. The company shared its revenue goals at the unveiling of its satellites. Along with a summary of the event, we here at the SORABATAKE editorial department would like to share an estimation of how many satellite images they will need to sell to achieve their goals.

Axelspace has made their name manufacturing microsatellites and providing satellite-based solutions. They recently released their plans to launch four more GRUS small satellites in March of 2021. If successful, it would upgrade their earth observation service, which currently revolves around their GRUS-1A satellite, from a single satellite system to a five satellite constellation.

On November 26th, during the press event when the company unveiled their new satellites, they also released revenue objectives with the new satellite system. Along with a summary of the event, we here at the SORABATAKE editorial department would like to share an estimation of how many satellite images they will need to sell to achieve their goals.

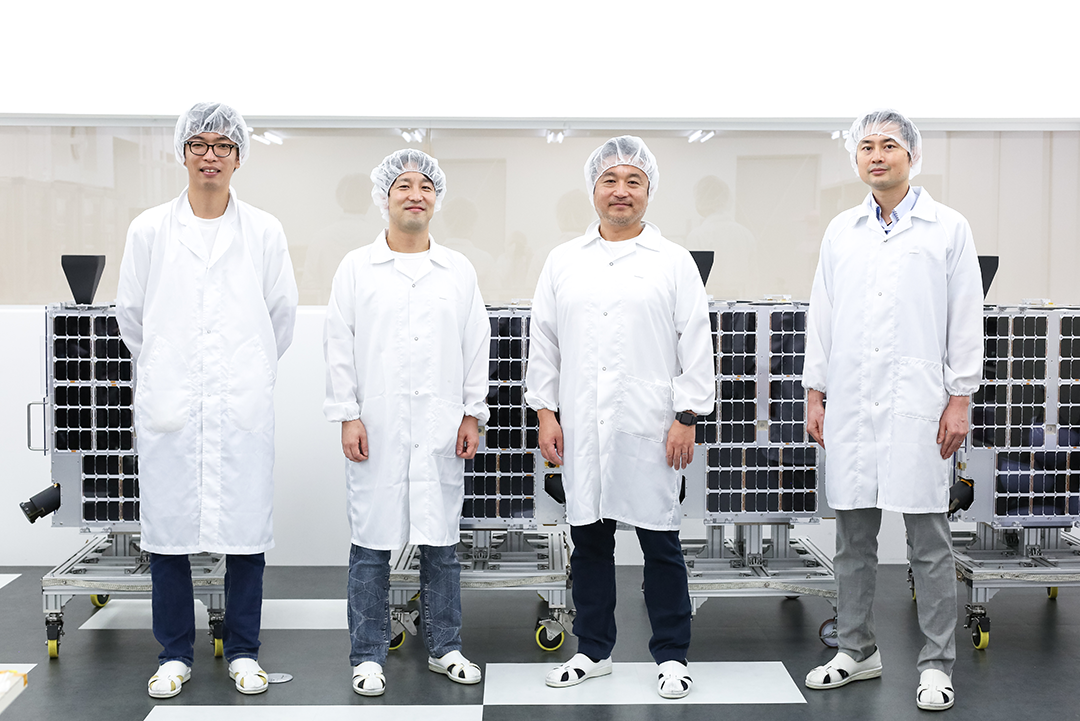

A New Manufacturing Group making use of DX and Digital Technology to achieve Mass Production

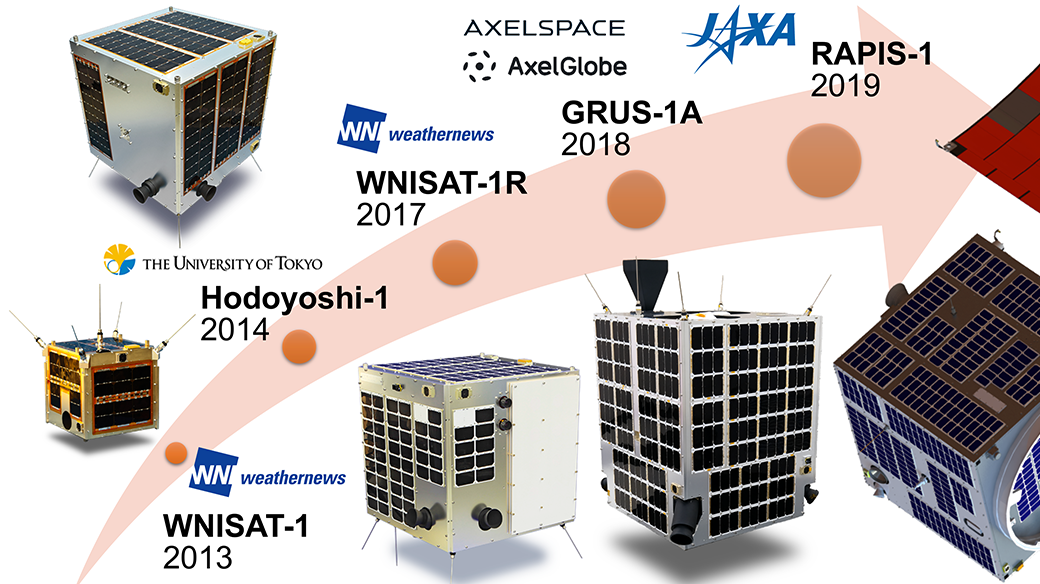

The event started with Axelspace’s CEO, Mr. Yuya Nakamura, giving an overview of how their business has worked up until now. The company started 12 years ago as a space industry start-up at Tokyo University. The company employs over 80 staff members and has launched 5 satellites to-date.

Hired by Weathernews, they launched their first two weather and oceanographic observation satellites in 2017, the WNISAT-1 and its recovery vessel, the WNISAT-1R. Weathernews uses these satellites to monitor the distribution of sea ice in the northern hemisphere. They use this data to publish navigation information for the Arctic Sea.

Their next satellite was the Hodoyoshi-1, a 60 kg small satellite. The smooth launch of this satellite marked the success of a new, more simple manufacturing method which functioned effectively even without state-of-the-art technology.

They were able to launch their lnext satellite, the GRUS-1A, in December of 2018. After taking their first imaging with the satellite in March of 2019, they went on to begin AxelGlobe, their earth observation service, in May. AxelGlobe allows users to pick a spot where they want GRUS to capture image data, and for that data to be downloadable online.

In January 2019, they also helped launched the RAPIS-1 to demonstrate new satellite technology designed, developed, and operated by JAXA. This satellite used components developed by universities and the private sector and was a test to see whether or not they functioned properly in space.

After finishing his introduction of the company’s background, Nakamura went on to explain that Axelspace excels at developing satellites that weigh around 200 kg.

From a global perspective, the 5 kg satellites created by the Planet Company, a space start-up at the forefront of the industry based in the United States, are incredibly small, and thus very cheap to make. They’ve already launched over 200 such satellites. Nakamura points out, though, that there are limits to the quality of the image data satellites of such a small size can capture.

Using agriculture as an example, there are times when information only available only at the pixel level can have an impact on how useful the data is. That being said, it takes a lot of time and money to design and launch satellites that weigh tons. The sweet spot, according to Nakamura, is around 100 kg.

With AxelGlobe having 5 satellites at its disposal, the question on everyone’s mind during the press conference was how Axelspace would expand its service? With one satellite, AxelGlobe is capable of capturing one image every two weeks, but with five this increases to an image every two days.

This is Axelspace’s first attempt at mass-producing satellites.

Up until now, design, development, and testing for Axelspace were conducted by its spacecraft design and development group. For this project, they revamped their manufacturing process by creating the DMAG (digital manufacturing acceleration group) which utilizes DX and digital technologies to better cater to mass production. Axelspace CTO, Naoki Miyashita, says that their aim is to “minimize costs and time required throughout the entire manufacturing process.”

Since being established in 2008, Axelspace has been able to raise over five billion yen (including loans). During their Q&A session, one of the reporters asked what it would take for their new service to produce profits.

The comments made by the CEO were, “The service is set to start three months after launching the 4 new satellites in June 2021, and our goal is to have it churning a profit within half a year (by September 2021)” and “We’re hoping to have a monthly revenue of 100 million yen to start out with, and eventually increase this to tens of billions of yen within three years.”

To hit their annual revenue goal, they need to sell 67 million km2 worth of images a year

So just how hard is it for a satellite start-up to bring their annual revenue to around 10 billion yen?

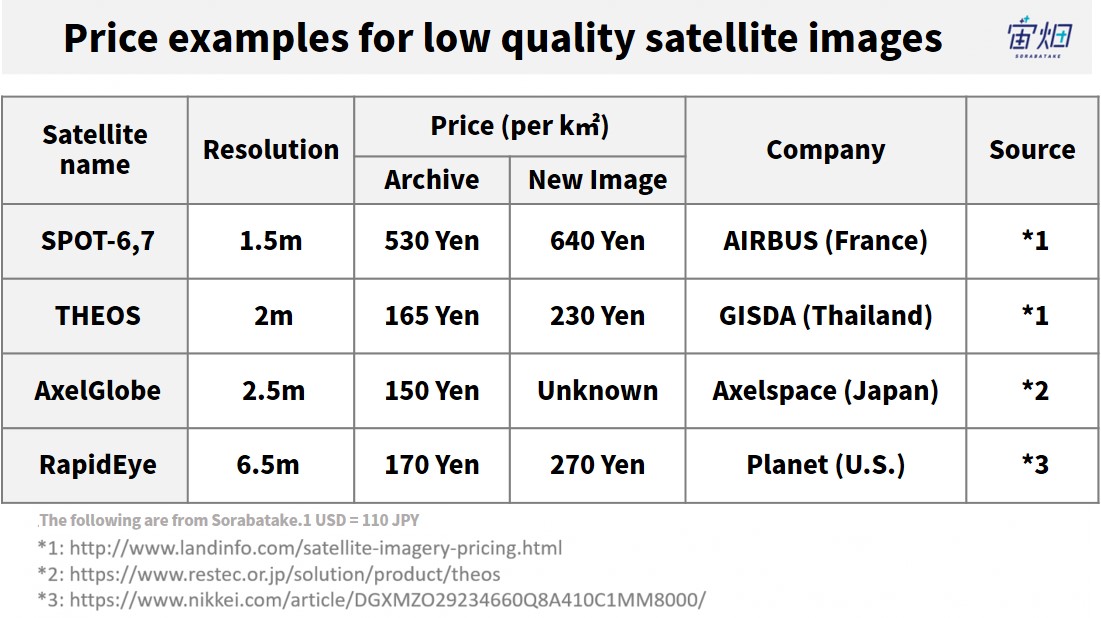

The price of satellite imagery is generally determined by its resolution or how recent (if it is a new image or from an archive) it is. It varies depending on the company, but the 1 km2 price from archive images can cost 1,400-2,000 yen for high quality images, 450-1,000 for medium quality images, and 150-530 yen for low quality images.

Axelspace’s GRUS satellite series has a resolution of 2.5 m, meaning it produces lower quality images. The company has their prices at about a tenth of the cost of a western satellite, with GRUS-1’s per km2 price reported at 150 yen when it was launched in April, 2014.

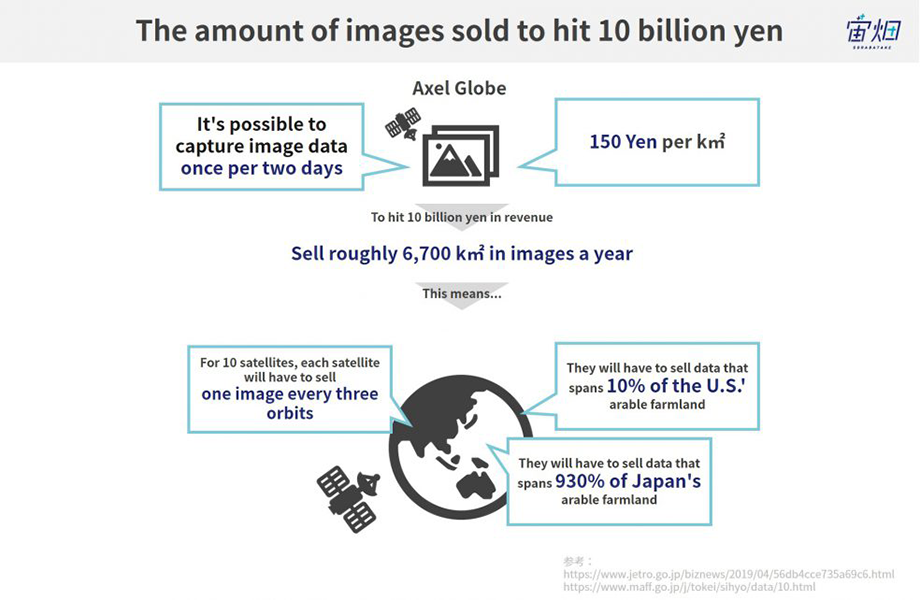

If Axelspace’s ambition is to bring in 100 billion yen a month by September 2021, and annual revenue of 10 billion yen within three years relying solely on revenue generated by AxelGlobe, then the amount of image data they need to sell is as follows.

(1) Monthly revenue of 100 million yen ⇒ Approx. 8 million km2/year

(2) Annual revenue of 10 billion yen ⇒ Approx. 6.7 million km2/year

With their new five satellite system, they can now capture an image every two days. To meet their goal, they can record satellite data 180 times a year, so dividing the surface area above by 180 tells us how much data they will need to gather every two days.

(1) Monthly revenue of 100 million yen ⇒ Approx. 44,000 km2/2 days

(2) Annual revenue of 10 billion yen ⇒ Approx. 370,000 km2/2 days

Let’s think in terms of agriculture to better visualize this, as it is an example of an industry that will likely make use of AxelGlobe’s satellite data.

Japan has a total of 40,000 km2 of available farmland.

The share they will need to be paid to collect image data on is as follows.

(1) Monthly revenue of 100 million yen ⇒ Approx. 110% of total farmland in Japan

(2) Annual revenue of 10 billion yen ⇒ Approx. 930% of total farmland in Japan

It doesn’t look like they will be able to meet their goals relying solely on Japanese agriculture. They may need to consider finding clients abroad as well.

For example, in the United States, they would have to account for the following share of the 3.7 million km2 of arable farmland there to meet their goals.

(1) Monthly revenue of 100 million yen ⇒ Approx. 0.9% of total farmland in the USA

(2) Annual revenue of 10 billion yen ⇒ Approx. 10% of the USA’s total farmland

The next question is, how many pictures are the GRUS in orbit capable of producing in the first place?

Five satellites ⇒ Each satellite captures 13,400,000 km2/year and 36,700 km2/day

If the GRUS observational area is 60 km × 60 km

The range it can capture in one orbit is 3,600 km2 ⇒ 10 images a day = an image every 1.5 orbits

With their new focusing on setting up a business centered around mass production, they will likely launch more satellites within the next three years.

If they have ten satellites ⇒ Each satellite captures 6,700,000 km2/year and 18,400 km2/day

They could capture 36,000 km2 per orbit ⇒ 5 images a day = 1 image per 3 orbits

They will need to have their satellites focus on spots with high demand and increase the number of satellites in their constellation to improve their image quality.

To make their business profitable, they will focus on the value of their imagery and other services

So how are companies providing satellite services around the world doing? Let’s take a look at Planet Labs, a company that has launched over 150 satellites and is predicted to bring in over 25 billion yen a year.

The service provided by Planet range from “Planet Tasking”, which involves gathering image data on a spot specified by their client, to “Planet Explorer”, an archive of images from the past. They have successfully increased the value of their image archive by selling the same image to multiple customers.

Planet also has tools available to help analyze satellite image data. The key to increasing company revenue in this industry may be in how much added value can be further provided to the imagery, and the range of services made available.

The Key to Success: Amount of Imagery + Value Per Image

However, Planet may not be the best comparison for Axelspace due to the sheer number of satellites they have in space.

Planet Labs gathered around 40 billion yen to fund their launch of over 150 satellites, and are currently increasing the amount of images across the globe. It’s likely their strategy relies on the amount of images they own.

Axelspace, however, is using 5 billion yen to eventually create a fleet of around 10 satellites, so in order to reach their revenue ambitions, they may need to focus on the price of their imagery.

AxcelGlobe is a subscription based service that gathers image data over a 30 km area two times a month for a monthly cost of 100,000 yen. This cost covers their support fees as well. That puts their cost at 56 yen per 1 km2, making it available at around the third of the cost of other low quality image capturing satellites, a major selling point.

This comes with disadvantages though, as the lower image capturing frequency of Axelspace increases the risk of clouds blocking the spot their client may want to observe. Their subscription model is probably their way of working around this risk.

Axelspace's Advantage as a Latecomer

How is Axelspace poised to compete with Planet, the satellite technology powerhouse in terms of volume and revenue?

Nakamura mentioned during the press conference that he wanted to “optimize the amount of satellites they have in space.” Their goal at Axel Globe is to have a constellation of 50 satellites that focus on capturing data on the area directly under satellites.

When looking at competitors, however, they realized that many of them have decided not to record information on certain parts of the earth, such as the sea or deserts. Axelspace hopes to gather data that sells well by using a few satellites to record data on spots that have strong demand in comparison with predecessors who have satellites everywhere.

There is a direct correlation between the price of a company’s image data and the amount of satellites they have in space, so Axelspace aims to gain an advantage in this regard over the competition.

A constellation of five satellites allows them to update their images every two days. It is exciting to see what Axelspace will do about their pricing and other services they will offer on AxelGlobe.

[Reference]

A comparison between Japanese, Korean, and Chinese farms and fisheries.