Summary of Government Support Programs and Budget Allocations for the Space Industry in Japan: Space Strategic Fund, SBIR, Stardust Program, and K Program

We have summarized the objectives and overall picture of the space technology development support that the Japanese government is actively promoting, the status of support by category, and points to watch going forward.

The unprecedented large-scale technology development initiative, the Space Strategy Fund, with a total budget of 1 trillion yen over 10 years, is drawing significant attention. In the FY2023 supplementary budget, a total of 300 billion yen was already allocated, and various ministries announced proposed themes. There were 130 applications from 247 organisations for 22 themes, and all adopted organisations were selected for all technology development themes.

Additionally, in March 2025, 24 phase 2 technology development themes will be set, with another 300 billion yen allocated. One notable point is the dramatic increase in the number of selected projects: while the phase 1 saw around 50 projects adopted, the phase 2 is expected to include about 140—more than double the previous figure.

Sorabatake has published interviews and articles with the Cabinet Office’s Space Development Strategy Promotion Secretariat, which was responsible for launching and designing the system of the Space Strategy Fund, as well as a follow-up article reviewing the phase 1 selections and exploring the objectives behind the phase 2 technology themes. We encourage you to take a look at those as well.

Related articles (Japanese)

This article also focuses on government initiatives beyond the Space Strategy Fund that support the space industry, including the SME Innovation Promotion Project (SBIR Phase 3), the Space Development and Utilization Acceleration Strategy Program (commonly known as the Stardust Program), and the Program for the Development of Important Technologies for Economic Security (commonly known as the K Program). It provides a comprehensive overview of the current landscape of space technology development support in Japan.

We hope this article serves as a useful resource for considering the present and future of the space industry.

(1)Goals Outlined in the Basic Plan for Space Policy and KPIs in the Basic Policy of the Space Strategic Fund

Let us first look at the vision Japan aims to achieve through its space development efforts.

The Basic Plan for Space Policy, a 10-year policy framework that plays a vital role in shaping Japan’s space initiatives over the next 20 years (approved by the Cabinet on June 13, 2023), clearly defines a quantitative target related to market size:

“To make the space industry a growth sector of the Japanese economy, the goal is to expand the market size—combining space equipment and space solution markets—from 4 trillion yen in 2020 to 8 trillion yen in the early 2030s.”

In addition to this numerical target, the plan also sets four further state targets, each accompanied by a vision for the future (The diagram below summarizes the overview, and more details can be found here).

So, what goals are outlined in the Space Strategic Fund?

The Basic Policy of the Space Strategic Fund, released on April 26, 2024, defines three thematic areas: “Transportation,” “Satellites, etc.,” and “Exploration, etc.” Within these, it sets three intended outcomes: “Market Expansion,” “Solving Social Issues,” and “Pioneering New Frontiers.”

The overall objective of the fund is described as accelerating and strengthening efforts toward the following goals aligned with those outcomes:

・Expanding space-related markets

・Contributing to solving global and societal challenges through the use of space

・Deepening space exploration activities and strengthening fundamental technological capabilities

To achieve these goals, the fund establishes a set of performance indicators, including outputs (e.g., number of supported projects) and short- to long-term outcomes (e.g., progress in technology development themes, commercialization by private companies, number of national missions, published papers, and patents). Progress will be reviewed regularly.

In fact, specific KPIs have been set for each of the three thematic areas: “Transportation,” “Satellites, etc.,” and “Exploration, etc.”

Transportation

・Envisioning a situation where domestically built and overseas satellites—and a wide variety of launch needs—can be met, realize a low-cost space-transportation system.

KPI:Secure domestic launch capacity for about 30 mainstay and commercial rockets per year by the early 2030s.・Build the necessary industrial base in Japan to ensure autonomy and self-reliance, acquire the technologies needed for next-generation space-transportation systems, and thereby raise Japan’s international competitiveness.

Satellites, etc.

・Enable autonomous satellite systems—from small to large spacecraft—for communications, Earth observation, and other services, led by domestic private operators (including start-ups), so as to strengthen international competitiveness.

KPI: Construct five or more systems by domestic private companies by the early 2030s.・At the same time, establish the required industrial base in Japan, secure autonomy and self-reliance, and obtain revolutionary satellite core technologies that will boost Japan’s global competitiveness.

・Expand the market through the use of satellite systems, including those described above.

KPI: By the early 2030s, achieve 30 or more new, socially implemented communication and satellite-data services—inside and outside Japan—provided by domestic private firms.

Exploration, etc.

・Secure Japan’s international presence in lunar, Martian, and deep-space exploration, as well as in the expansion of the human sphere of activity.

KPI: By the early 2030s, have domestic private companies and universities newly participate in ten or more missions/projects to the Moon, Mars, and beyond.・Create and expand businesses by Japanese private companies in the post-ISS era from the 2030s onward.

KPI: By the early 2030s, create 10 or more businesses by domestic companies that utilize low-Earth orbit.・Leverage these opportunities to generate outstanding scientific results in fields such as planetary science and astrophysics, and contribute to large-scale international programs.

In the next section, we summarize other government support programs beyond the Space Strategic Fund, focusing on which space development technologies are receiving priority in terms of budget allocation.

(2) It's not just the Space Strategy Fund: A Summary of Government Support and Budgets for Space Development

In this section, we present a summary of four government support programs for the space industry, including not only the Space Strategy Fund but also the SME Innovation Promotion Project (SBIR Phase 3), the Space Development and Utilization Acceleration Strategy Program (commonly known as the Stardust Program), and the Program for the Development of Important Technologies for Economic Security (commonly known as the K Program). The summary outlines what kinds of space development technologies are receiving funding and how the budgets are distributed.

The table below plots the types of space technologies currently funded and the budget amounts under each program.

Please note that this is a simplified version.

※In addition to the four government support programs covered in this survey, there are also government-led initiatives such as the S-Booster, the NEDO Prize Program, and other demonstration support schemes. Each ministry also releases information about their regular space-related budgets, so we encourage interested readers to check those out as well.

Now, let’s take a look at the combined funding allocations across different categories of government support.

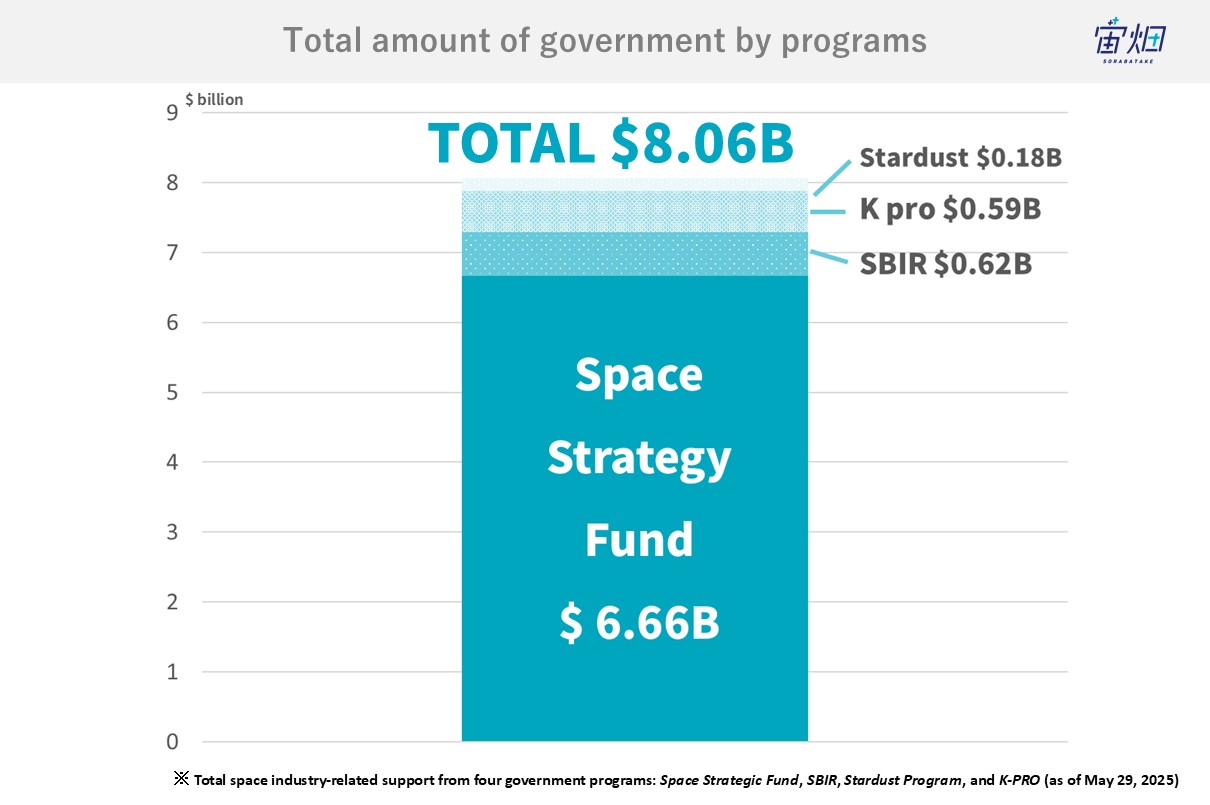

1.Total Confirmed Funding Stands at Approximately $8.06 billion, with Around $5.33 billion Allocated to Finalized Themes

Let’s begin by looking at the total budget currently allocated across the four government support programs. When we include portions of the Space Strategy Fund that have not yet been finalized, the combined maximum amount of government investment is set at approximately 1.2 trillion yen($8.06 billion).

Focusing only on the budgets allocated to confirmed themes, nearly 800 billion yen($5.33 billion) has already been designated for specific space technology development initiatives.

To put the 1.2 trillion yen scale into perspective, the final reported cost of hosting the Tokyo 2020 Olympic and Paralympic Games was around 1.4 trillion yen (including 640.4 billion yen from the organizing committee, 596.5 billion yen from the Tokyo Metropolitan Government, and 186.9 billion yen from the national government).

So, will this level of investment in space development actually generate positive economic impact?

Although somewhat dated, a study on the European Union’s Copernicus Earth observation program provides some insight. According to this paper, every €1 invested in Copernicus generated €1.39 in direct economic impact within the space sector (with further ripple effects expected in other industries, resulting in even greater overall economic impact).

Of course, since Copernicus is an Earth observation program, these figures cannot be universally applied to all space-related technologies. It may be difficult to calculate precisely how much investment is needed to expand Japan’s space market from its current scale to 4 to 8 trillion yen. However, through multiple lenses—including the budget allocations outlined below—we at Sorabatake hope to reflect in 5 or 10 years on which themes truly contributed to expanding the market.

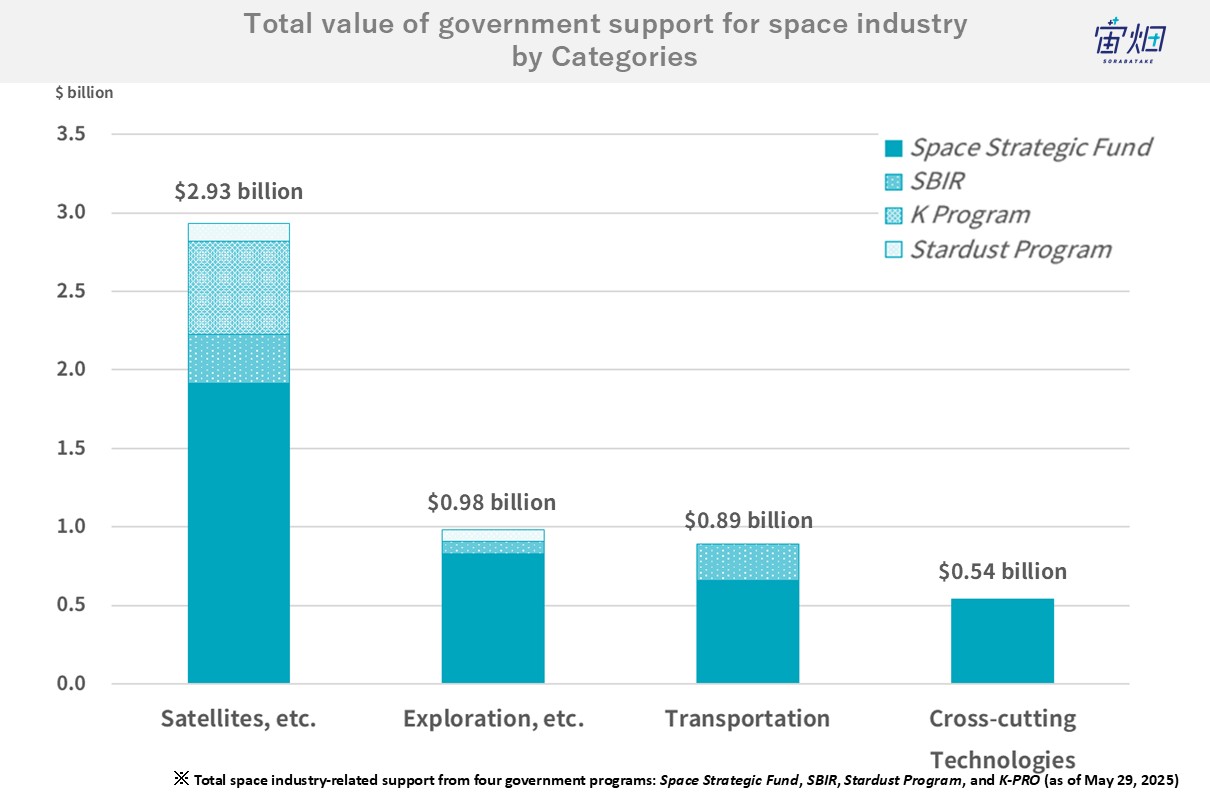

2.How Is the Budget Distributed Among “Transportation,” “Satellites, etc.,” and “Exploration, etc.”?

Among the three support categories outlined in the Space Strategy Fund—namely “Transportation,” “Satellites, etc.,” and “Exploration, etc.”—which category is receiving the largest share of funding?

For the first two phases of the Space Strategic Fund, as well as support programs other than the Space Strategic Fund, Sorabatake has assigned fields to each support content, and the results are shown below.

The analysis reveals that the “Satellites, etc.” category is receiving the most support, followed by “Exploration” and then “Transportation, etc.”

While this trend is partly due to the K Program and Stardust Program placing significant emphasis on satellite-related development, even when examining only the Space Strategy Fund and SBIR programs individually, “Satellites, etc.” remains the most heavily funded category.

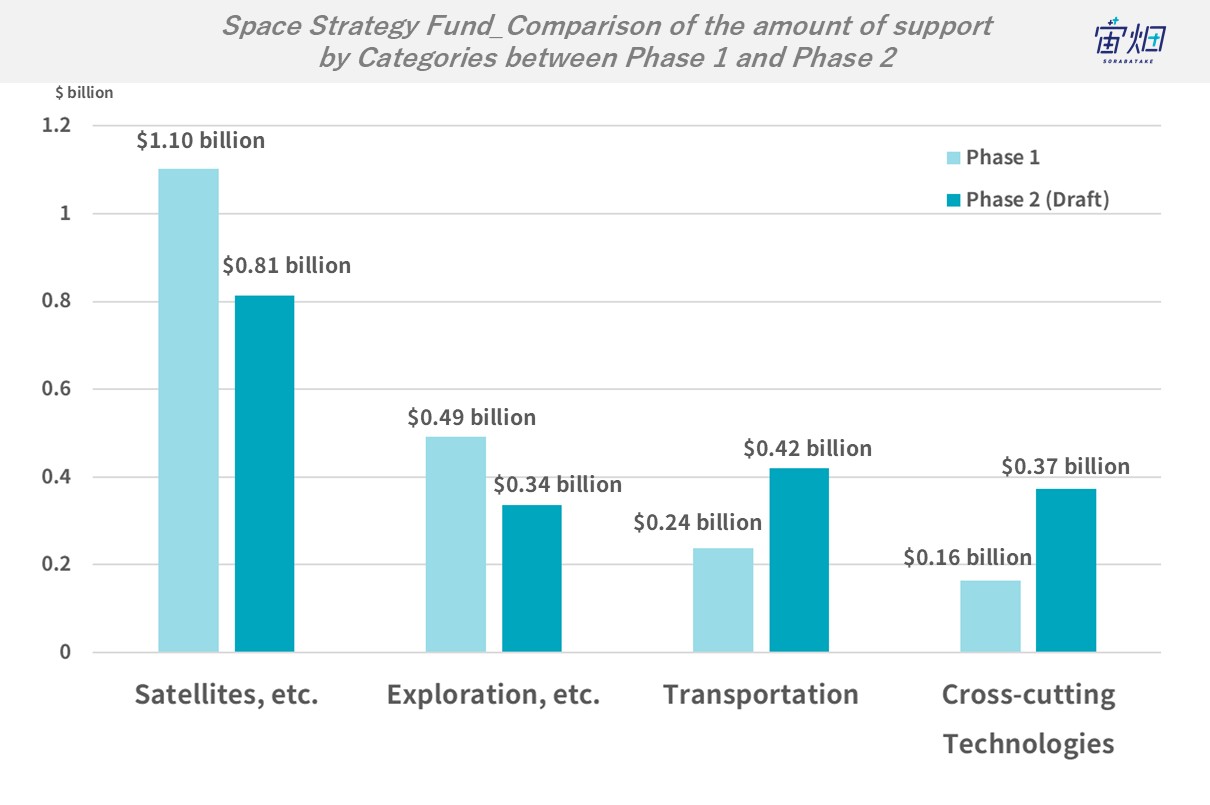

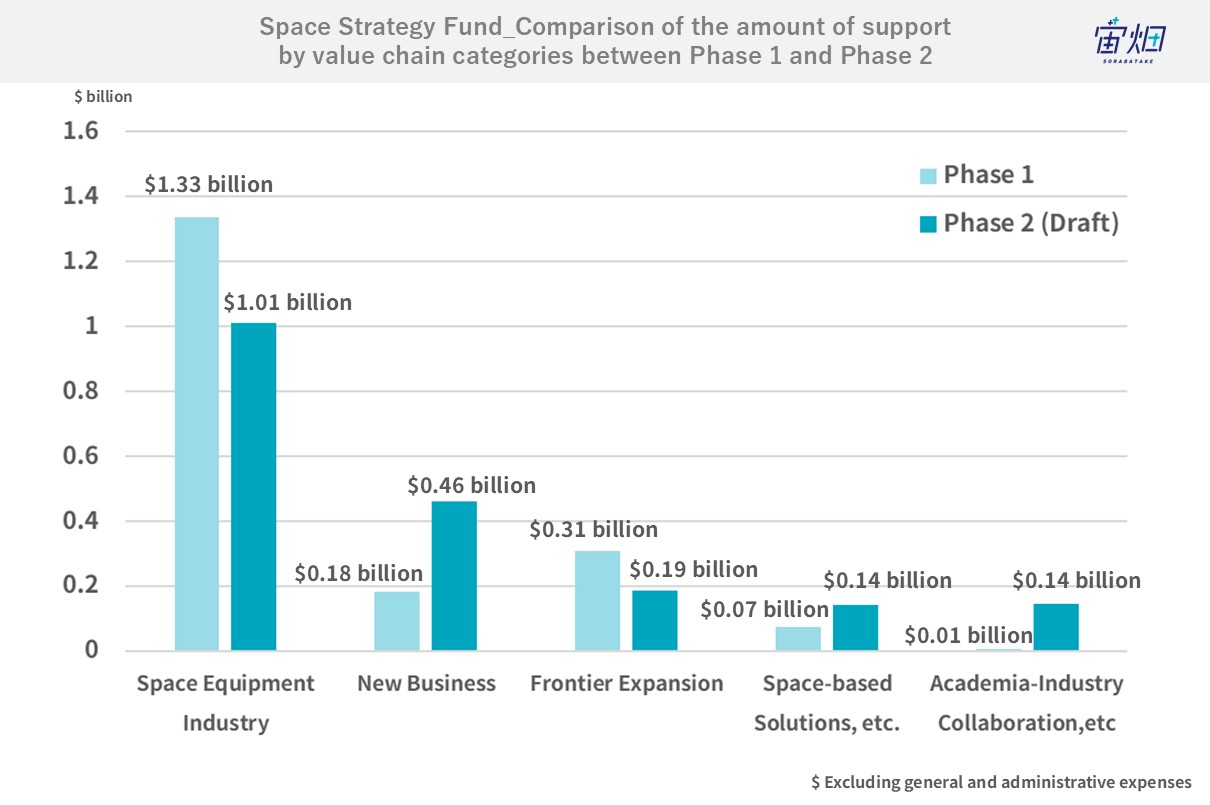

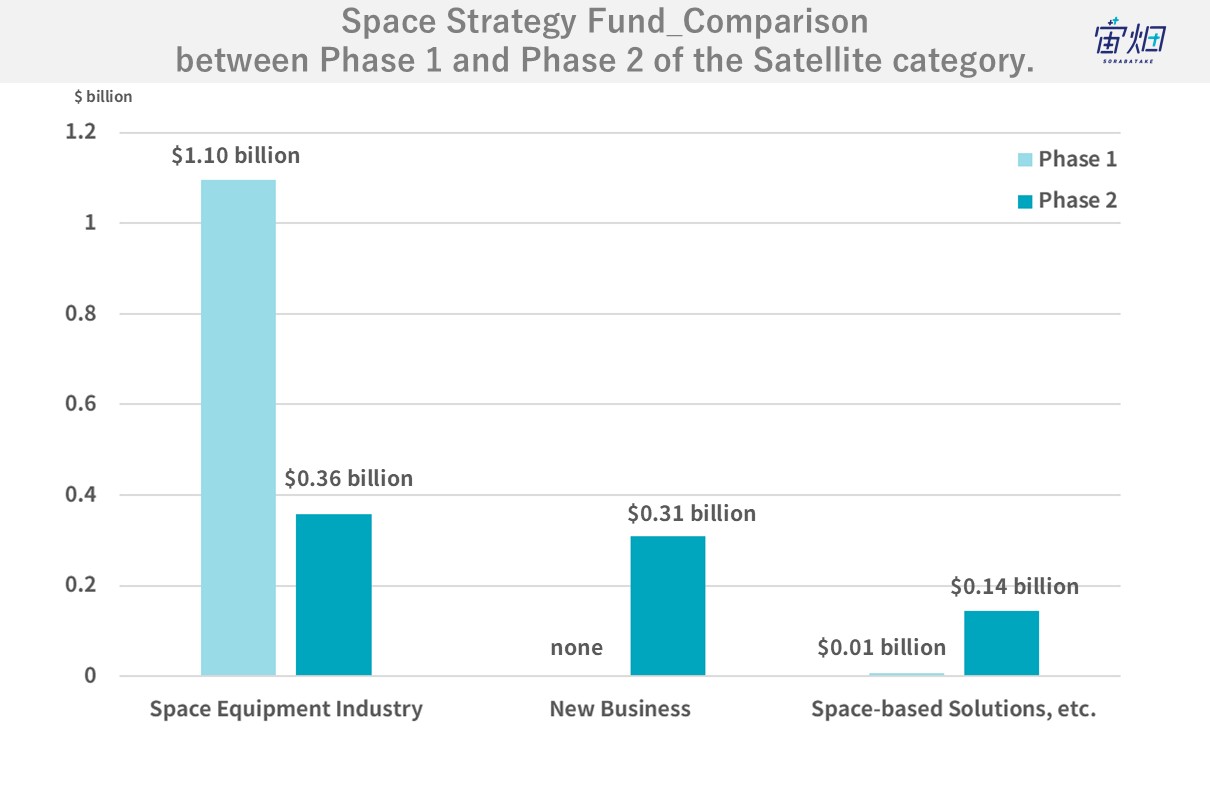

Below is a comparison of the budget allocations between phase 1 and phase 2 of the Space Strategy Fund under the same classification criteria.

As with phase 1, the largest share of the budget continues to be allocated to “Satellites, etc.” in phase 2. However, there has been an increase in the budget assigned to “Transportation” and “Cross-cutting Technologies”.

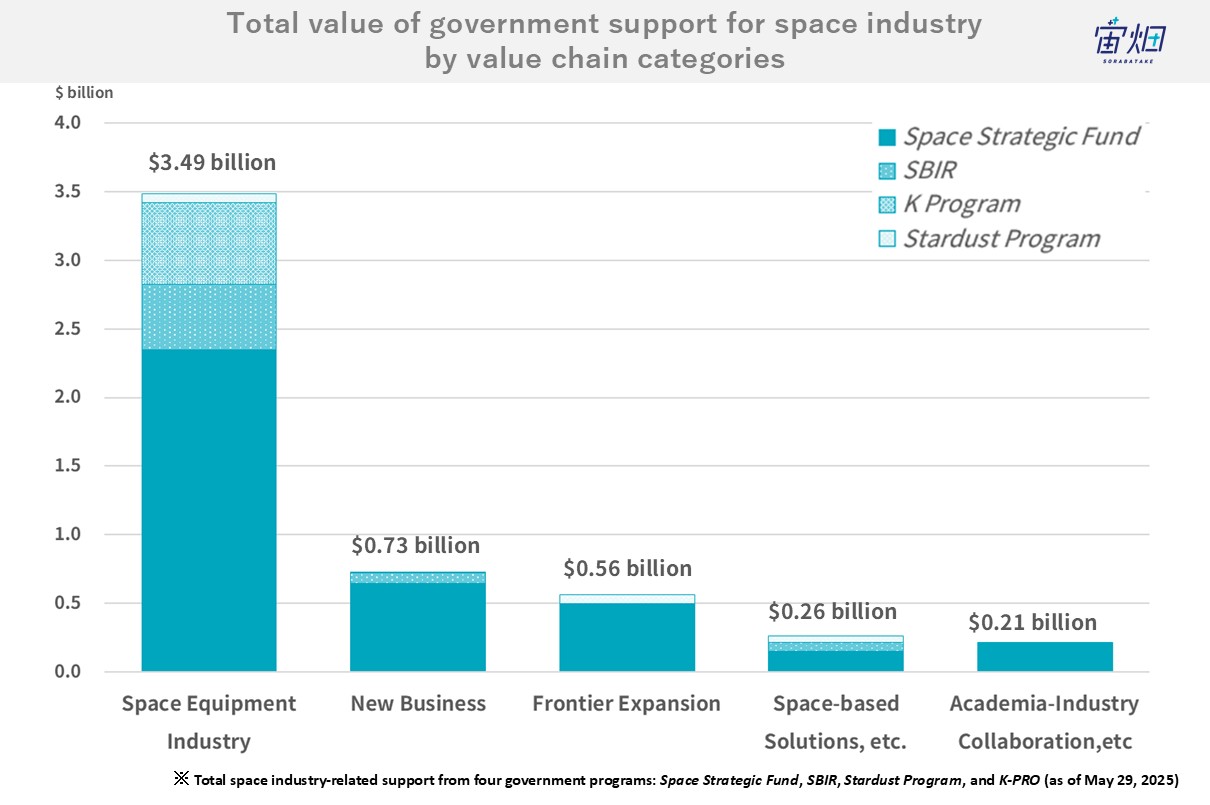

3.Space Equipment Industry Receives the Largest Share When Viewed by Value Chain Category

When considering the value chain categories, we referred to the materials from “About the Space Strategy Fund (Overall Overview)” published on April 26, 2024.

We classified the support initiatives into the following five categories:

1.Space Equipment Industry (e.g., rockets, satellites, core components, fundamental technologies)

2.Space-based Solutions & Social Issue Resolution

3.Frontier Expansion & Scientific Exploration

4.New Business (R&D, Entertainment, Education, Lunar Economy, etc.)

5.Academia-Industry Collaboration and Cross-Sector Contributions

The aggregated results of this categorization are shown below.

The data reveals that the Space Equipment Industry—which includes rocket and satellite development, as well as key supporting components and foundational technologies—receives the largest share of support.

The budget will then be allocated in the following order: “New Business (R&D, Entertainment, Education, Lunar Economy, etc.)”, ”Frontier Expansion”, “Space-based Solutions” and “Academia-Industry Collaboration”.

These results align with the three key goals presented in Chapter 1 of this article regarding the Space Strategy Fund:

・To establish a low-cost space transportation system capable of meeting diverse launch needs, including domestically developed and international satellites.

・To enhance the international competitiveness of Japan’s private sector in satellite systems—from small to large satellites for communications, Earth observation, and on-orbit services.

・To secure Japan’s international presence in exploration beyond the Moon and Mars by expanding the frontiers of human activity.

Additionally, when comparing budget allocations between phase 1 and phase 2 of the Space Strategy Fund, we see a notable increase in funding for New Business, as well as growth in support for Academia-Industry Collaboration and Space-based Solutions.

In our May 2025 interview article “Talking with the Cabinet Office’s Office for Space Policy: Review of phase 1 and Objectives for phase 2 of the Space Strategy Fund”, a key comment was:

“Our hope is that services using space technologies will become widely adopted, and people will one day say, ‘This service is actually built on technology born from the fund.’ That would lead to increased tax revenue and employment—this kind of self-sustaining cycle is the vision we aim for.”

This suggests that phase 2 of the Space Strategy Fund places more emphasis on how space technology can support industry and improve daily life here on Earth.

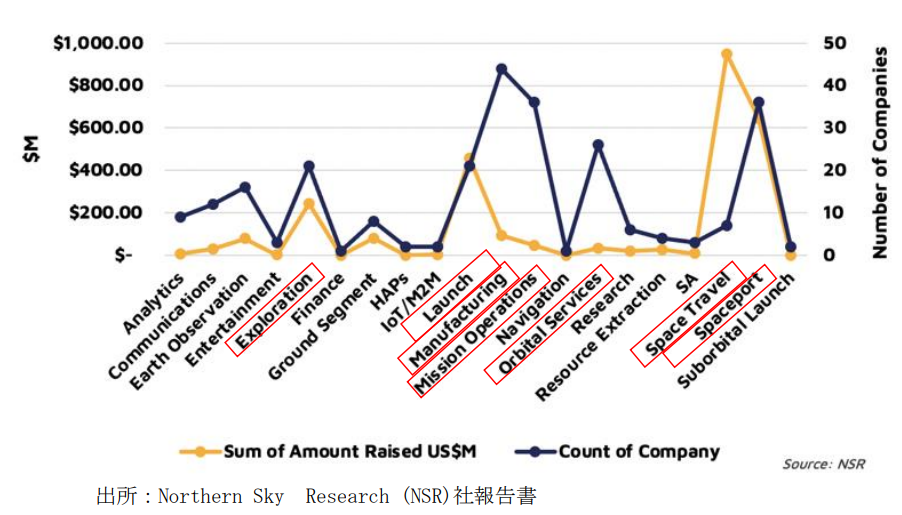

As a reference, the Japan External Trade Organization (JETRO) published a report in March 2022 titled “Trends in U.S. Space Policy, Industry, and the Small Satellite Market.”

This report cited findings from NSR, showing that from 2000 to 2020, the U.S. government invested $36 billion in the private sector.

The breakdown showed that the largest portion of funding went to:

1.Human spaceflight

2.Spaceports

3.Transportation

4.Exploration

One particularly interesting insight from the report is NASA’s use of Space Act Agreements to promote the commercialization of infrastructure.

NASA traditionally took an “infrastructure procurement and ownership” approach, in which it acquired and owned assets by covering all development and construction costs. In recent years, however, rather than owning infrastructure itself, the agency has adopted a approach in which it supports private companies in developing technology and promises to become the user of the infrastructure once it is completed.

The report concludes:

“This can be understood as part of public financing and investment aimed at promoting space industry commercialization by emerging space companies, rather than as direct government budget expenditure.”

This approach—allocating funding not through simple subsidies but by becoming the end-user of commercially developed services—is a key strategy that Japan would do well to monitor and consider adopting in the future.

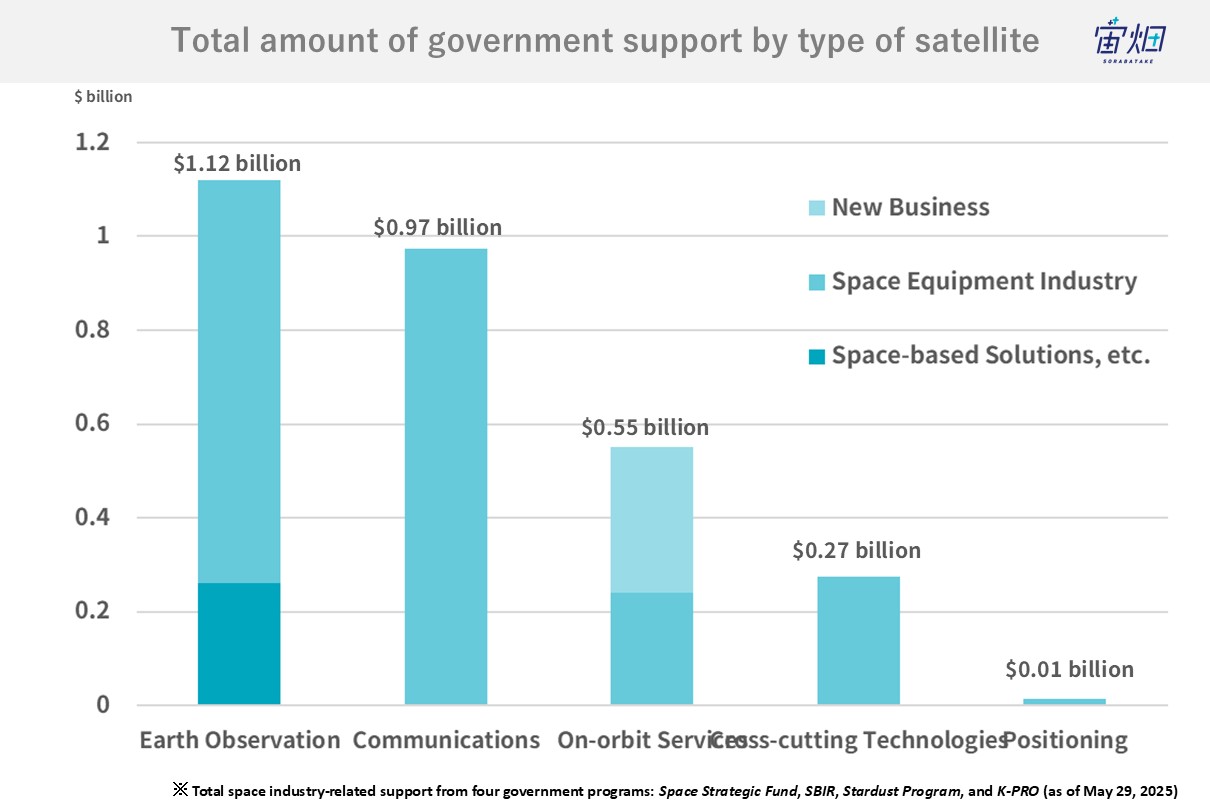

4.Earth Observation Receives the Most Support Among Satellite Types

As previously discussed, the “Satellites and Related” category received the most funding among support areas, and the “Space Equipment Industry” led in value chain categories.

Based on this, we further broke down the satellite category into four types:

・Earth Observation

・Communications

・Positioning

・Cross-cutting Technologies (technologies not specific to a satellite type)

We then cross-tabulated these satellite types against the value chain categories.

The results are as follows:

The data shows that Earth Observation receives the largest amount of funding, followed by Communications, On-orbit Services, Cross-cutting Technologies, and Positioning in that order.

Significant funding in the Earth Observation category has been allocated to the development of optical and SAR satellite constellations, as well as new sensors like multiple wavelengths and LiDAR systems. This indicates that the government sees Earth observation data not only as a tool for national security but also as a driver of economic ripple effects across multiple industries.

Also, in phase 1, if we focus on the budget for Earth observation, a large budget was allocated to the development of the satellites themselves and to so-called manufacturing, such as parts and components, but in the second phase, we can see that a large budget is also allocated to the space solutions industry and software for solving social issues.

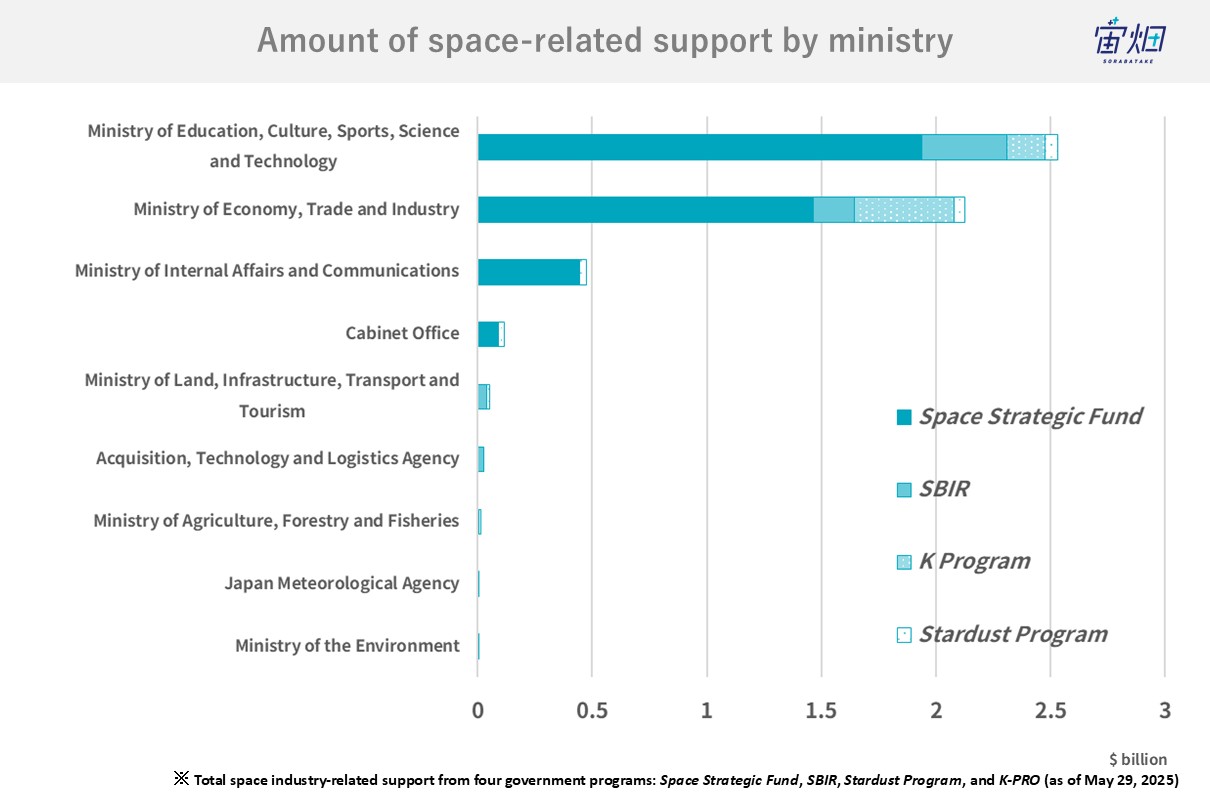

5.Ministry of Economy, Trade and Industry (METI) Receives the Most Funding Among Ministries

Lastly, we aggregated budget allocations by ministry.

The data shows that:

・Ministry of Education, Culture, Sports, Science and Technology (MEXT) receives the most funding,

・Followed by the Ministry of Economy, Trade and Industry (METI),and the Ministry of Internal Affairs and Communications (MIC).

・The top three ministries have set budgets for the Space Strategy Fund.

Interestingly, prior to the launch of the Space Strategy Fund, in FY2023 (Reiwa 5), the space-related budget was:

・216.6 billion yen for MEXT

・21.12 billion yen for METI

Given that background, the fact that METI now receives significantly increased funding suggests a clear intent to meet one of the major goals outlined in Japan’s Basic Space Policy: expanding the space market.

On the other hand,Ministry of Land, Infrastructure, Transport and Tourism (MLIT),Ministry of Agriculture, Forestry and Fisheries (MAFF),Japan Meteorological Agency (JMA),Ministry of the Environment (MOE) also receive space-related funding, particularly as users of satellite services. However, their budget allocations remain much smaller compared to MEXT or METI.

From the perspective of expanding the space economy, it is crucial to consistently develop satellite services that these user ministries genuinely want to adopt. Drawing from the NASA example mentioned earlier, a user-driven approach, where budgets are allocated to ministries to develop services they want and will use, could become an important strategy for Japan moving forward.

(3) Government Budget Aims to Solve Challenges Faced by Non-Space Industries and Local Governments through Satellite Data Utilization

One might wonder whether the government support budget outlined above is exclusively allocated to companies already participating in the space industry. The answer is: not necessarily.

In particular, when it comes to satellite data utilization, the primary beneficiaries of these budgets are often non-space companies and local governments.

For instance, Sorabatake has conducted numerous interviews showcasing real-world examples of satellite data applications, including:

・Kagome: Supporting knowledge transfer from veteran farmers and improving productivity in ketchup tomato cultivation

・Takasui (Fisheries): Enabling efficient fishing by inheriting the skills and experience of seasoned fishermen

・Tokio Marine & Nichido Fire Insurance: Accelerating insurance payouts in flood damage scenarios caused by natural disasters

・Kansai Electric Power: Optimizing power generation by improving solar power output forecasts

・City of Kobe: Reducing labor for patrolling abandoned farmland

・World Bank: Enhancing and monitoring geospatial information in countries lacking accurate maps

You can find many more such use cases in our interview collection, and we encourage you to check out any that interest you.

The above examples show how satellite data is already being actively utilized, but from the broader perspective of human history, its widespread application is still in its infancy. At Sorabatake, we believe in promoting further adoption of satellite data to build a better future, and we strongly encourage more people and organizations to explore its use.

That said, many people are understandably concerned about the cost of using satellite data.

We have summarized the costs involved in acquiring satellite data in our article “0 yen to 3.887 billion yen for all of Japan?! A Complete Guide to Satellite Image and Data Pricing and Future Outlook.” The takeaway is that prices vary widely—some satellite data is available for free, while others may be very expensive.

Because satellite data usage is considered an essential driver for industry growth, various government support programs are in place to promote its adoption.

For example, in phase 2 of the Space Strategy Fund, a new initiative called “Accelerating Implementation of Satellite Data Utilization Systems” is expected to be launched. It plans to select around 30 proposals, signaling an intent to embrace a wide range of demonstration projects.

In addition to these, competitive grant programs offering financial and networking support also exist. “NEDO Challenge, Satellite Data – Updating the agriculture, forestry and fisheries industries with satellite data!” is one of these.

We hope you’ll consider entering the world of satellite data utilization or exploring other avenues within the space business. If you are considering doing so, we welcome you to contact Sorabatake or Tellus, which operates Sorabatake.

(4)Government Support Outcomes to Analyze in the Future

In this article, we visualized the currently announced themes and budget allocations related to Japan’s government support for space development.

With that foundation, from what perspectives should we track various indicators in order to evaluate progress toward the future goals?

While the question of how to measure these metrics can be set aside for now, here are some of the key points that Sorabatake is particularly interested in.

1.Economic Ripple Effects of the Current Investments

In Chapter 2, we introduced a paper analyzing the return on public investment in Copernicus, the European Union’s Earth observation program. Similarly, NASA has published an Economic Impact Study (summary) that analysis the economic effects of its space programs.

It is critically important to reflect on the outcomes of public investment and apply those insights to future policymaking. We hope that quantitative impact assessments will be published for the current government initiatives as well—and we at Sorabatake are considering whether we can perform our own estimates.

Incidentally, there are ongoing efforts in Japan to utilize quantitative data more effectively in space policy and strategy, which we have introduced in a separate article.

2.Trends in the Ratio of Overseas Procurement Within Government Budgets

In 2022, not a single rocket was launched from Japan. Currently, Japanese commercial satellite developers rely on foreign launch vehicles due to cost and availability factors. A report titled “Understanding the Environment and Future Outlook for Space Transportation” published by the Cabinet Office provides an overview of this situation.

However, in February 2024, Japan finally succeeded in launching its long-awaited new mainstay rocket, the H3. As noted earlier, one of the KPIs is to achieve a domestic launch capacity of 30 launches per year by the early 2030s.

If Japan successfully builds at least five satellite systems, as targeted, and simultaneously enhances both its launch technologies and supply capacity, we can expect less capital to flow overseas and more domestic demand to be fulfilled within Japan.

This kind of external dependency is not limited to the space industry. In the IT sector, for example, there has been growing concern over Japan’s increasing payments to U.S. digital giants like GAFAM. In 2023 alone, this resulted in a so-called “digital trade deficit” of approximately ¥5.5 trillion.

Also, it is not just transportation that is of concern as the ratio of orders placed overseas changes. The same can be said for the parts that make up the satellites and rockets themselves, the cloud that stores the satellite data required to use satellite services, the terminals required to access information from positioning satellites, communication equipment, and ground stations.

From the standpoint of economic security, monitoring these procurement ratios is crucial. In times of crisis, it is vital for Japan to enhance its autonomy in areas ranging from rocket launches and satellite development to satellite service operations. In fact, the word “autonomy” appears repeatedly in the overview of the Space Strategic Fund.

As Japan’s space technologies continue to advance and reach a globally competitive cost level, we hope that a sustainable domestic foundation will emerge—one in which both the public and private sectors can expand space development and space-based industries in the long term.

3.Changes in Japan’s Competitive Advantage and Presence in International Relations by 2035

During a recent interview with the Secretariat of the Strategic Headquarters for Space Policy in the Cabinet Office, Sorabatake asked the question:

“Through the Space Strategy Fund, what position does Japan aim to achieve in the global space industry by the 2030s?”

At the time, “Although we currently lag behind the United States and China in terms of the number of launches, I believe there is potential for us to become a competitive player that can meet domestic and international demand. There are also Russia, India, and Europe, but Japan can be unique and create a situation in which we have an advantage in competition with them.”

Currently, Japan relies heavily on foreign rockets to transport its commercial satellites. If Japan can build competitiveness in transportation, it won’t just meet domestic demand—it will also be able to serve the growing global demand for commercial satellite launches. This could significantly expand Japan’s space industry market.

Furthermore, building not only competitive strength but also a strong international presence is vital for advancing international space development.

For example, in NASA’s Artemis program, it has been agreed between the Japanese and U.S. governments that two Japanese astronauts will land on the Moon. This reflects Japan’s growing presence in global space initiatives.

Going forward, we will closely watch how Japan’s international competitiveness and presence in the space field continue to evolve.

4.Shifting Budget Allocation Ratios: Rockets, Satellites, Operations, Services, and Exploration

The three key outcomes discussed so far—economic ripple effects, the share of overseas orders, and Japan’s global presence—are all areas we want to evaluate by 2035.

What Sorabatake finds particularly interesting is the distribution of the space budget that leads to those results: how much is allocated to rocket development, satellite development, satellite operation, satellite service utilization, and space exploration.

As discussed in Chapter 2, currently the largest portion of the space budget is allocated to the “satellite-related” category, especially satellite development and launches. This shows where current priorities lie.

However, this raises further questions:

・Is the budget for transportation (i.e., launch systems) sufficient?

・Is there enough investment in ground stations, which form the infrastructure of satellite systems?

・Are we adequately funding the social implementation of satellite-based solutions that could expand market size?

These discussions are vital. Budget allocation strategies are key indicators for understanding how Japan intends to grow its space industry in the coming years.

The current Space Technology Strategy notes that the plan will be “rolled” annually—meaning it will be updated based on the latest conditions. Sorabatake is also paying close attention to these evolving strategies and the context behind them.

5.Shifting Public Perceptions of the Space Industry

Lastly, one outcome of government support that Sorabatake is particularly interested in—though not necessarily linked directly to market expansion—is how over 100 million people living in Japan and paying taxes perceive the space industry.

The massive $7.9 billion budget introduced in this article ultimately comes from taxpayers like us.

However, unlike automobiles or everyday goods, the space industry is not something the general public purchases directly. As a result, most people rarely consider how space-related technologies benefit their daily lives. This makes it a sector that is often questioned: “What’s in it for us if our taxes are used for space?”

To explore this, Sorabatake conducted an original survey between May 18 and May 20, 2024, asking 1,000 people across Japan aged 10 to 70 about their image of the space business.

First, we asked whether they supported or opposed the Japanese government’s large-scale support of the space industry, as discussed in this article.

Over 70% responded in favor, while slightly less than 30% opposed. At Sorabatake, we were relieved to see that a majority are supportive.

Many of the comments reflected the belief that the space industry will nurture crucial technologies for Japan’s future:

“I think the quality of life in the future will vary greatly depending on whether a country has sovereignty over space technologies. I feel that space will become increasingly linked to various aspects of life—industry, energy, national defense.”

“Beyond data acquisition from satellite launches, I believe the space industry still holds many untapped possibilities.”

“In the future, countries that succeed in space business will have a stronger economy, and large-scale funding is key to that success. Since private sectors alone may not be able to keep up, I support government investment.”

However, even among those in favor, there were respondents who expressed concern that Japan is lagging behind other countries:

“Japan seems to be a little behind compared to other countries in space development.”

“Japan has often been late to enter various industries, so I think it’s wise to invest in sectors with potential—even if it’s only a little.”

On the other hand, the main argument among those who opposed was that there are more pressing domestic issues to address before investing in space:

“Before investing in space, we need to rebuild the overall economy. While space business may lead to new technological developments, it’s hard to support it unless social and economic conditions improve and there’s broader public consensus.”

We also asked respondents about their awareness and understanding of the Space Strategy Fund and cross-tabulated their answers with their stance on government investment. The data showed that those who were unaware of or unfamiliar with the fund were more likely to oppose the investment. This suggests that clearly and broadly communicating the significance of the space industry, its development, and its relevance to our everyday lives is essential.

In reality, satellite services and ground-based facilities—those that provide convenience and value to people on Earth—occupy the majority of the market. Shifting public perception to better understand this reality could also help increase support for the space industry.

We’re excited to see how these perceptions will evolve over the next decade. Ideally, more people will come to understand that the growth of the space industry brings tangible benefits to their lives. Sorabatake is committed to continuing and expanding our efforts to communicate these points and foster greater public support for government investment in space.

(5)Afterword

We have compiled the current state of Japan’s government support for space technology development, including the Space Strategy Fund.

In writing this article, the Sorabatake editorial team reviewed a wide range of domestic and international policies and reports and received comments on an interview article with the Cabinet Office. Through this process, we gained valuable insights from multiple perspectives on Japan’s space policy.

We sincerely hope that the content and findings we’ve shared in this article will provide useful reference points for your work—if even in a small way.

If you are interested in accessing the spreadsheet compiled during our research for this article, please feel free to contact Sorabatake.

Additionally, based on the survey results introduced in Chapter 4, we’ve begun compiling a summary to help more people recognize how space development is relevant to our daily lives. We plan to publish this content soon, and we hope you’ll look forward to it.